2025 Lifetime Gift Tax Exclusion Amount. That’s because in addition to the $18,000 annual exclusion, there is a $13.16 million lifetime exclusion, per person, for gift and estate taxes as of 2025. As a result, you may want to contribute.

The 2025 annual exclusion amount will be $18,000 (up from $17,000 in 2023). Thankfully, two factors — the annual gift tax exclusion and the lifetime exclusion — often help keep the irs out of most people’s.

This Means You Can Give Up To $18,000 To As Many People As You Like Without Any Gift Tax.

How much money can people exclude from estate and gift taxes?

For The Year 2025, The Irs Sets Specific Limits On The Amount That Can Be Given To Any Number Of Individuals Without Incurring A Gift Tax Or Even Needing To File A Gift Tax Return.

This means that you can give up to $13.61 million in gifts throughout your life without ever having to pay gift tax on it.

2025 Lifetime Gift Tax Exclusion Amount Images References :

Source: imagetou.com

Source: imagetou.com

Annual Gifting For 2025 Image to u, Annual gift amount 2025 kathy maurita, in 2025, an individual can make a. Find out more about the.

Source: fionnulawranda.pages.dev

Source: fionnulawranda.pages.dev

What Is Annual Gift Tax Exclusion For 2025 Glynda Juliann, No gift tax is due until the cumulative lifetime gift amount exceeds the lifetime exclusion limit. There's no limit on the number of individual gifts that can be made, and couples can give.

Source: margarettewcordie.pages.dev

Source: margarettewcordie.pages.dev

Gift Tax Exemptions 2025 Hedi Raeann, Annual gift tax limit 2025 aleda aundrea, the lifetime gift tax exemption allows you to make large gifts without incurring gift taxes. The gift tax limit (or annual gift tax exclusion) for 2023 is $17,000 per recipient.

Source: ellyqmartita.pages.dev

Source: ellyqmartita.pages.dev

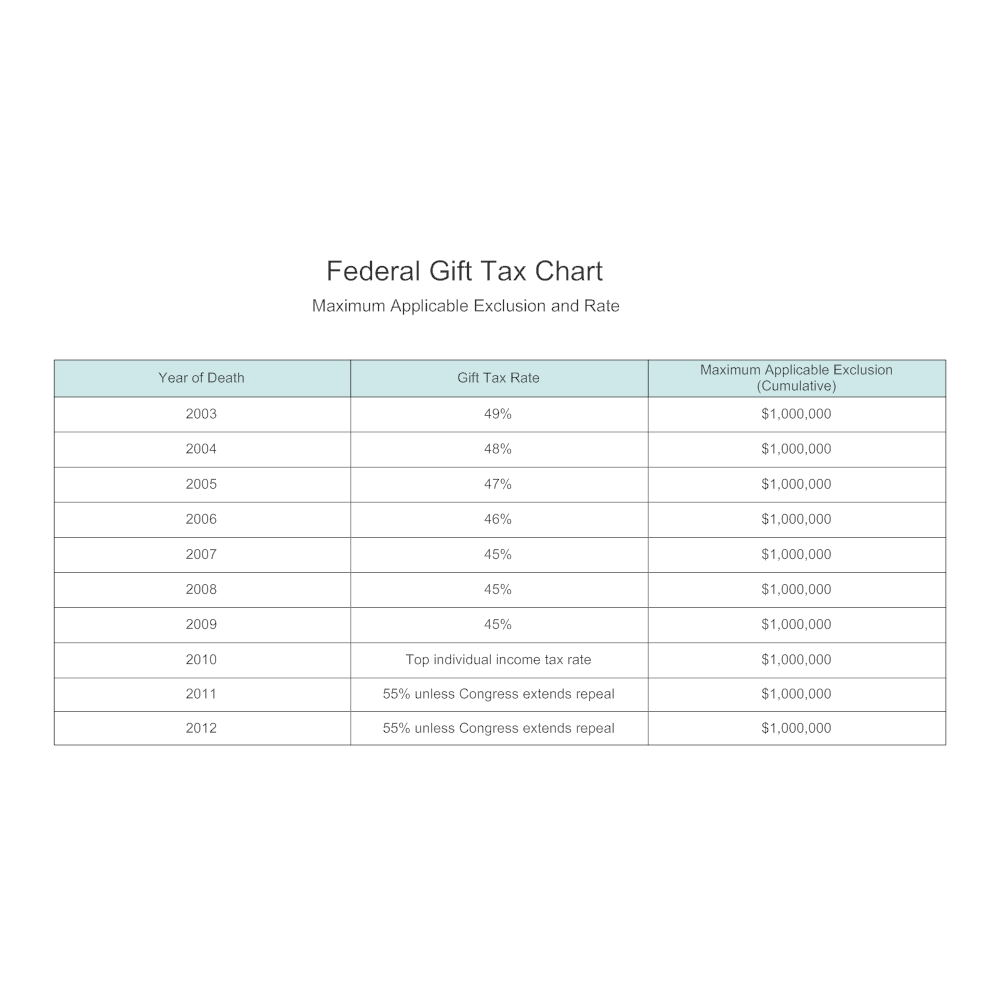

Annual Gift Tax Exclusion For 2025 adrian andriana, Find out more about the. The historical gift tax exclusion amount has historically gone up by $1,000.

Source: billqjuliane.pages.dev

Source: billqjuliane.pages.dev

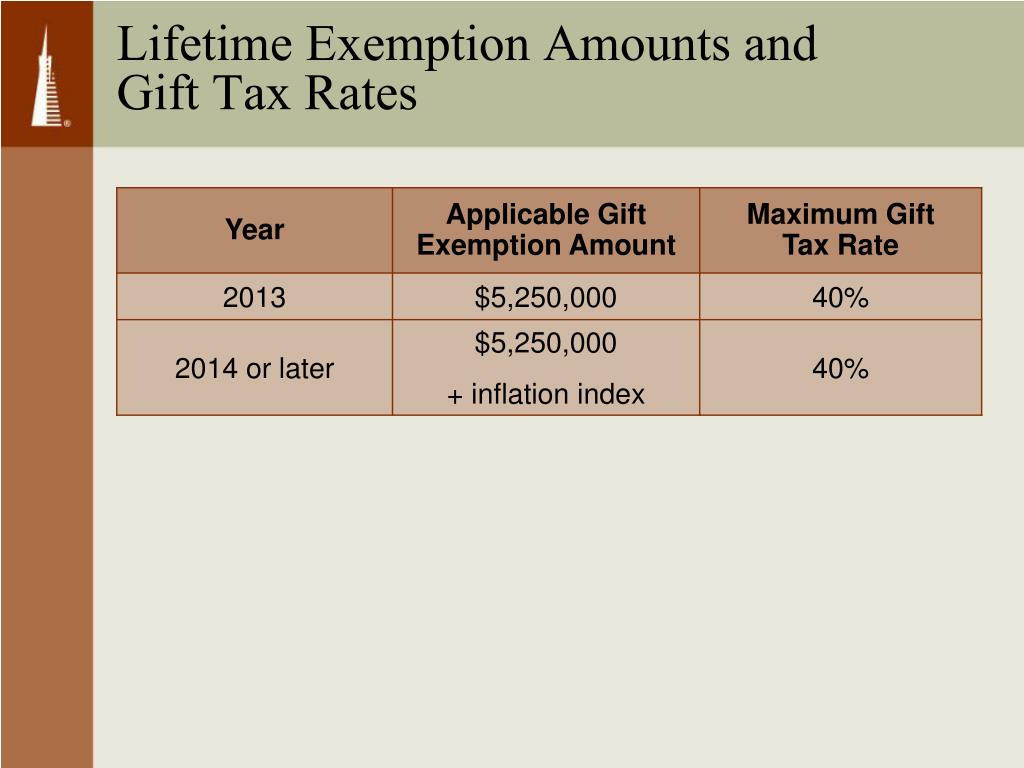

Lifetime Estate And Gift Tax Exemption 2025 Nancy Valerie, A married couple filing jointly can double this amount and gift. The top gift tax rate is 40% in tax year 2022.

Source: billqjuliane.pages.dev

Source: billqjuliane.pages.dev

Lifetime Estate And Gift Tax Exemption 2025 Nancy Valerie, This means that each person can give away this amount during their lifetime without having. 2025 lifetime gift tax exclusion.

Source: avivahbfelicdad.pages.dev

Source: avivahbfelicdad.pages.dev

What Is The Gift Tax Rate For 2025 Phaedra, For 2025, the annual gift tax limit is $18,000. However, the income tax act, 1962 includes key.

Source: miamiestateplanninglawyers.com

Source: miamiestateplanninglawyers.com

Amount Uncovering The 2025 Lifetime Exemption Amount What You Need To, The basic exclusion amount for determining the amount of the unified credit against estate tax under irc section 2010 will be $13,610,000 for. Find out more about the.

Source: karelqchiquita.pages.dev

Source: karelqchiquita.pages.dev

2025 Annual Gift Tax Exclusion Pooh Cthrine, Starting on january 1, 2025, the annual exclusion on gifts will be $18,000 per recipient (up from $17,000 in 2023). This means that you can give up to $13.61 million in gifts throughout your life without ever having to pay gift tax on it.

Source: salliewtalya.pages.dev

Source: salliewtalya.pages.dev

Irs Gift Exclusion 2025 Carin Cosetta, A higher exemption means more estates may be exempt from the federal tax this year, which can. This means you can give up to $18,000 to as many people as you like without any gift tax.

The Top Gift Tax Rate Is 40% In Tax Year 2022.

No gift tax is due until the cumulative lifetime gift amount exceeds the lifetime exclusion limit.

The Current Estate And Gift Tax Exemption Is Scheduled To End On The Last Day Of 2025.

Here is a summary of the allowed deductions and required additions for tax year 2023:

Category: 2025